Prior To Fannie Mae And Freddie Mac Bailout How Did They Compete For Funding

Eighteen months later, the Trump administration has finally outlined a plan to reshape the two government-backed mortgage firms. But, like other aspects of the administration's recent to overhaul the federal government, the suggested reshaping of Fannie and Freddie doesn't go nearly far enough. 'It's not removing government from the housing sector; it may shift government subsidies from Fannie and Freddie to other entities, but that's it,' says John Berlau, senior fellow at the Competitive Enterprise Institute.

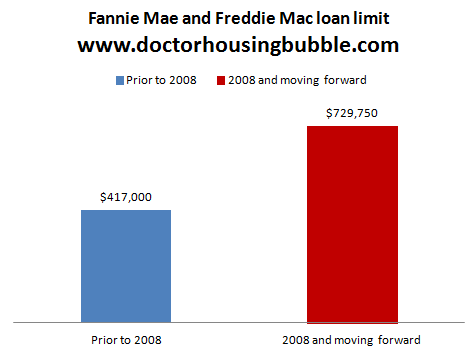

While the Trump administration's plan does advocate terminating the conservatorship of Fannie and Freddie, the proposal would also permit new firms to apply for the same type of charter, creating an environment where many more of these corporations might proliferate, bankrolled by the government. More importantly, the proposal does little to ameliorate the 'affordable housing goals' that lend themselves to dangerous lending policies. 'They're saying they will make the implicit support for the GSEs explicit,' says Berlau. 'It's going to be something the government commits to and taxpayers are going to be on the hook for.' Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs)—that is, corporations created by an act of Congress—that purchase mortgage loans on the secondary market from banks, which they generally sell to investors in the form of mortgage-backed securities.

Nov 8, 2017 - Fannie Mae and Freddie Mac Still Endanger U.S. When other financial institutions that received TARP funds paid back what they owed to the U.S. However, Fannie and Freddie have paid back to the government. Pushed onto the terms of the GSE bailout and takeover, requires the.

August 23, 2018 Rift-To-Go added. September 6, 2018 High Stakes event, Grappler added. August 31, 2018 Shock Grenade added. August 15, 2018 Heavy Sniper Rifle added. August 7, 2018 Double Barrel Shotgun added. Iexplorer for mac september 11, 2017 — version 4.1.3.

While these GSEs don't engage in the business of loaning themselves, they put money back into the hands of the bank to engage in more lending, often more than would be permitted under general market conditions. They can do that because their securities are considered low-risk, like government bonds. Office 2016 for mac installer stuck on verifying.

They hold a multi-billion dollar line of credit with the U.S. Treasury, essentially guaranteeing taxpayer bailouts to these corporations in the event of another economic downturn. By artificially boosting mortgage lending, Fannie and Freddie inflate home prices, and—largely thanks to the political pressures—encourage banks to lend to borrowers more likely to default. Those factors played a role in the mortgage crisis that triggered the 2008 financial collapse.

In the wake of that economic catastrophe, the federal government took Fannie and Freddie into conservatorship. It now backs even more mortgages than it did before the financial crisis. If another mortgage crisis hits, Fannie and Freddie might need $100 billion in new bailout money, according to conducted by the Federal Housing Finance Agency. The solution to problems created by Fannie Mae and Freddie Mac isn't simply restructuring government programs, but instead completely eliminating them. In a recent, Heritage Foundation Research Fellow Norbert Michel described the dangers of the GSEs: 'The legacy of the GSEs, as it would be with any such private-public partnership, is crony capitalism, higher mortgage debt, higher home prices, taxpayer bailouts, and no appreciable expansion of homeownership.' Trump has a historic opportunity to affect real change in a sector that's been devoid of sensible reform for a long time.

Photo Credit: JASON REED/Reuters/Newscom. Fannie and Freddie were created for -- or rationalized based on -- a reason: In the post-war era of hyper-regulated banking, there was, supposedly, no way for east-coast money to get to west-coast borrowers.

So the federal government had to -- supposedly -- create a national system of mortgage securitization to fund the build-out of California and the Southwest. So one could -- supposedly -- cut to the [C]hase and note that we have nationwide banking now and don't need federally backstopped mortgage securitization anymore. But as the saying goes: Good luck with that. You mean the fraud work that happened by central planning enablement mentioned above by S=C? Without the first your piece doesn't happen.